Designate Midland Habitat as a Beneficiary

When you open a financial account or an insurance policy, you’re asked to designate a beneficiary of that account. Retirement accounts, investment accounts, bank accounts, life insurance policies, and certificates of deposit all require that you designate someone to receive the account assets after your lifetime. These assets transfer outside of a will or trust, through beneficiary designation forms you completed when the accounts were opened.

Reviewing your beneficiary designations periodically is a good idea to make sure they are complete and up-to-date. Your life circumstances may have changed or you may have new accounts that need a beneficiary to be designated. Make sure those you’ve entrusted the accounts to, such as family, other loved one, or causes you care about, match your current circumstances and wishes for after your lifetime.

How Beneficiary Designations Work

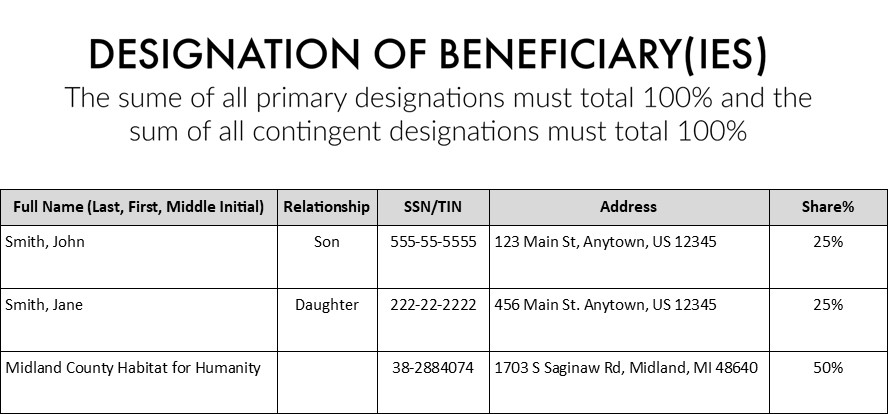

When you designate a gift to Midland County Habitat for Humanity (MCHFH) from your retirement plan, insurance plan, or other assets, you ensure that your money will help people attain a safe and affordable place to call home. It is as simple as contacting the firm that holds your assets and asking for a beneficiary designation form to fill out or update.

A sample beneficiary designation form. You can designate MCHFH as a sole beneficiary, a partial beneficiary, or a contingent beneficiary.

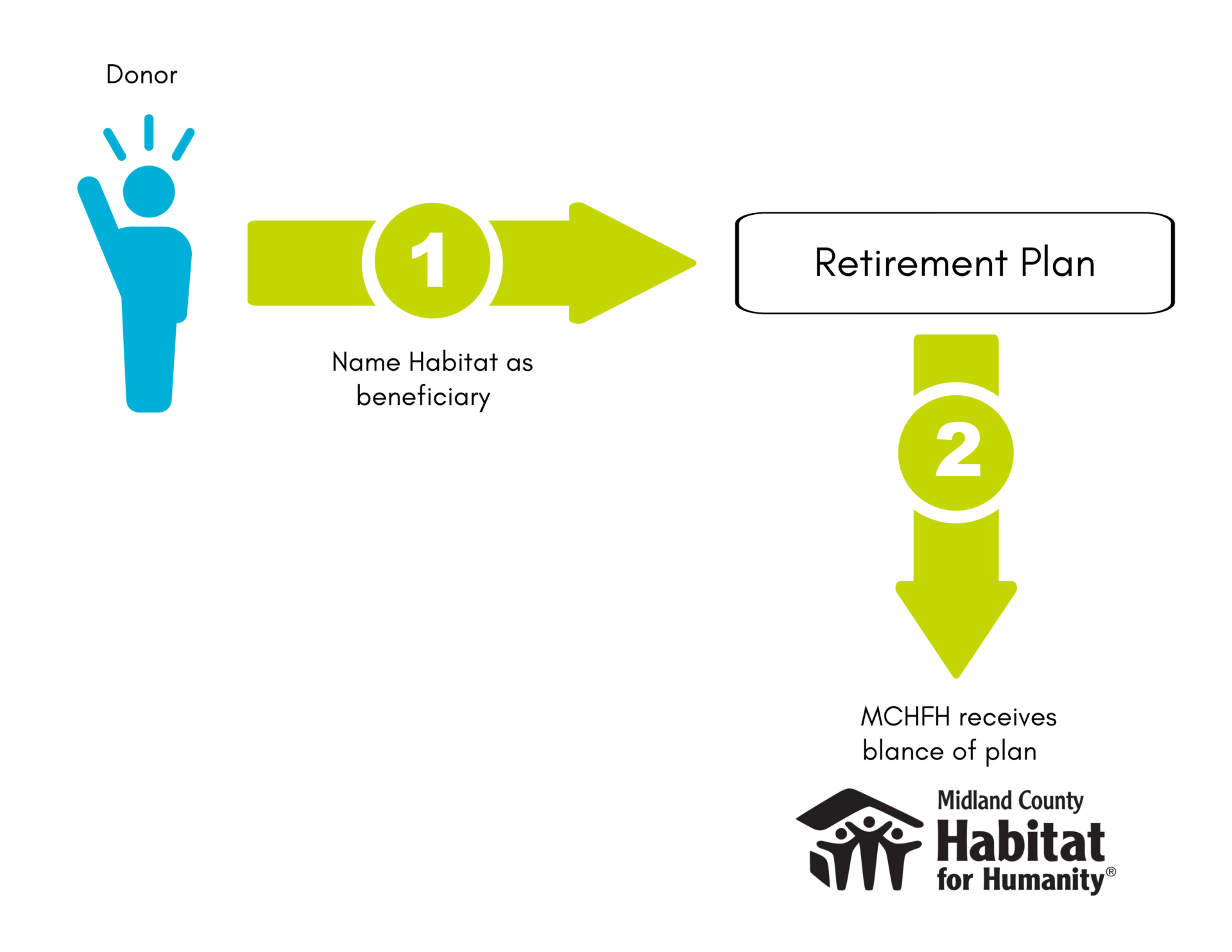

Designating a Retirement Account

Many retirement assets, including 401(k)s and IRAs, are among the most heavily taxed, making them an ideal opportunity for charitable giving once you no longer need them.

Income taxes to your beneficiaries on retirement assets can be as high as 35%. This means for example, that a $100,000 IRA will be worth only $65,000 by the time it gets to your loved ones.

Because Habitat is tax-exempt and eligible to receive the full amount, it bypasses any income taxes. This means that a $100,000 IRA given to Habitat will be worth the full $100,000. Your total amount would be invested in empowering families through safe, affordable shelter.

Here are some of the ways this gift benefits you:

- Reduce or eliminate taxes on retirement assets

- Remove highly taxable assets from your estate by direct beneficiary designation

- Reduce or avoid probate fees

- There is no cost to you now

Gifts of Insurance Policies

If you have a life insurance policy that has outlasted its original purpose, you can use it to fund a legacy gift while also enjoying tax savings during your lifetime.

Here are a few ways this benefits you:

- Donate ownership and receive a charitable income tax deduction for the market value of the policy.

- Receive additional tax benefits by making annual gifts so that we can pay the premiums.

- Some donated policies can be cashed in and put to good use right away.

- If you retain the policy and name us as beneficiary, the proceeds of your policy will be paid to Habitat for Humanity, and your estate will receive the tax deduction from the charitable gift receipt.

This information is not intended as legal, accounting or other professional advice.

For assistance in charitable planning, consult an attorney for legal advice or obtain the services of another qualified professional.

If you’d like to continue empowering families through better shelter by designating Midland County Habitat for Humanity as a beneficiary of an account, policy, or other asset please contact us:

Jennifer Chappel

President/CEO

989-496-0900

Download flyer to share with your financial or legal advisor.